‘Fifty Shades of Grey’ helps Barnes & Noble sales

- Share via

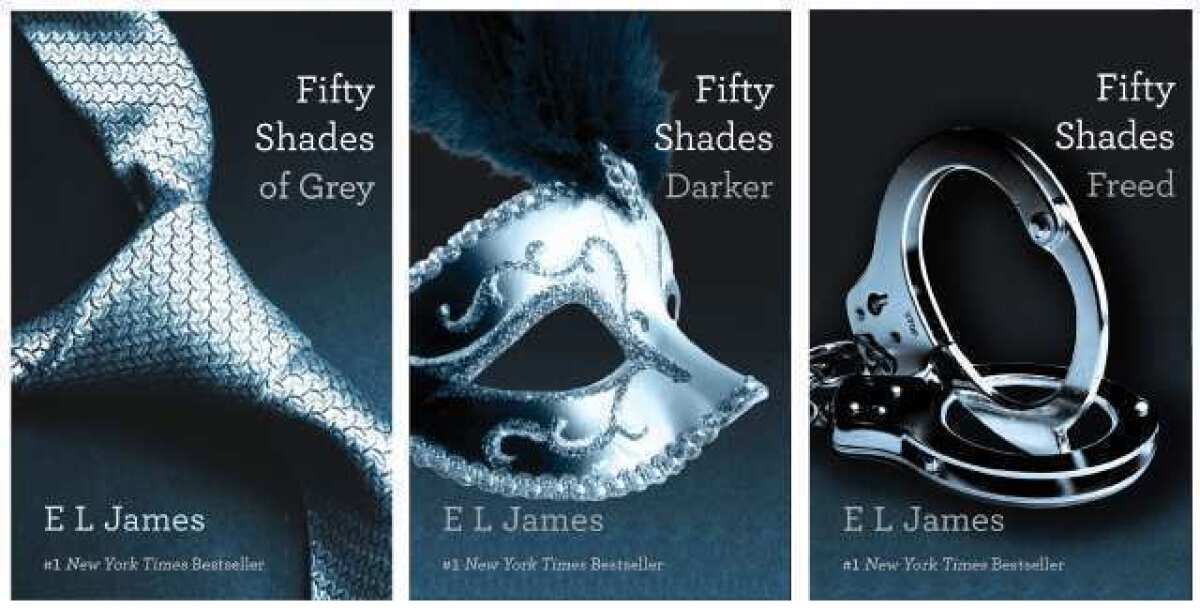

The raunchy novels in the “Fifty Shades of Grey” trilogy are serving a purpose beyond riling up housewives. The erotic tomes are whipping -- so to speak -- sales at Barnes & Noble Inc. back into shape.

The series by E.L. James -- often referred to as “mommy porn” for its themes of sexual submission and dominance -- helped boost the bookseller’s first quarter, which ended July 28.

Overall revenue at Barnes & Noble’s nearly 700 bookstores and BN.com rose 2% to $1.1 billion in the quarter. Though sales on the website declined, same-store sales in the brick-and-mortar shops jumped 4.6%.

Part of the increase is due to competitor Borders liquidating its stores last year, according to the company. But “strong sales” from “Fifty Shades” also contributed.

The racy series helped bring Barnes & Noble’s overall revenue for the quarter up 2.5% to $1.5 billion. The bookseller narrowed its net loss to $41 million, or 78 cents a share, from the year-earlier loss of $56.6 million, or 99 cents a share.

But figuring out exactly how much of a financial effect “Fifty Shades” had is “somewhat complicated,” especially considering that other popular titles such as “The Hunger Games” and “Harry Potter” also did well, said Chief Executive William J. Lynch.

Bestsellers usually make up about 5% of sales, Lynch said. And “Fifty Shades” has “not been our bestselling book ever by any means.”

The series “is a big piece” of the company’s first-quarter success and “had the biggest impact in the numbers,” said Mitchell S. Klipper, chief executive of Barnes & Noble’s retail group.

But there are many “smaller pieces” as well, including improved bookstore traffic and forays into the business of educational toys and games, Klipper said.

Barnes & Noble’s Nook digital business pulled in $192 million in revenue, which was flat compared with the same quarter last year. Sales of devices such as the e-reader declined due to lower selling prices and production scaling issues, but sales of digital content soared 46%.

Nook will become a new company come fall, when Barnes & Noble pairs with Microsoft Corp. to help its prospects against Amazon.com’s Kindle and Apple’s iPad.

Barnes & Noble’s stock slipped more than 4% in morning trading in New York, sliding to $11.82 a share from $12.35 a share Monday. The stock has been volatile over the last year, jumping to $20.75 a share on the Microsoft announcement this spring.

ALSO:

Barnes & Noble cuts Nook Tablet prices

Barnes & Noble to close its Westside Pavilion store

“Fifty Shades of Grey” merchandise heading for stores

Follow Tiffany Hsu on Twitter and Google+

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.